bank owned life insurance tax treatment

101 j 1 was added with the enactment of. The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a.

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Bank Owned Life Insurance and Tax Reform.

. Income earned on the policies is tax-free for the bank and when an employee dies the cash payments the company receives are tax-free. By far the biggest disadvantage is you pay for the insurance policy up front. Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and post-retirement employee benefits insurance on borrowers and.

What are the tax consequences of surrendering Bank Owned Life Insurance BOLI. If the tax treatment of Bank Owned Life Insurance BOLI changes existing plans may be grandfathered. 3200 Conclusion The use of Life Insurance may be a key financial decision for your business.

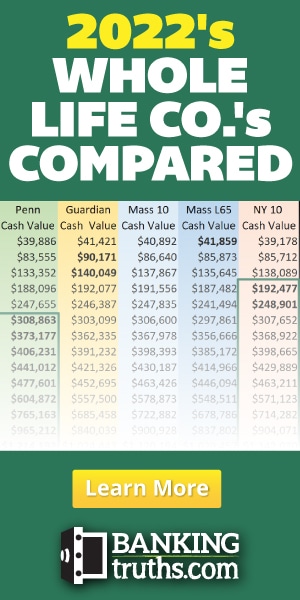

Cost Tax Treatment. Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits. Any gain above the premium that the bank paid would be taxed at the normal rate.

This general rule changed when Sec. But if they are not grandfathered they may be surrendered for their cash surrender values. The primary benefit of BOLI is tax-related.

Key Man Life Insurance. Experts tend to agree that one of the main selling points of BOLI is its tax-favored treatment. What are the tax consequences of surrendering Bank Owned Life Insurance BOLI.

Deferred compensation plans mean that an employee agrees to defer part of their compensation until a specified future date. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh. Deferred compensation plans are often used to supplement participation in 401 k plans.

This tax treatment of COLI policies explains a large portion of their usage because it is certainly possible for a corporation to make a similar. While any insurance owned by a bank can be referred to as BOLI the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an. Key man life insurance helps companies reduce the risk of business disruption by paying a death benefit if critical.

Bank-Owned Life Insurance and Imputed Income Tax Reimbursement Agreements Abstract BANK-OWNED LIFE INSURANCE AND IMPUTED INCOME TAX REIMBURSEMENT. Life Insurance premium expense account. Differences between Deferred Compensation Plans and 401 ks.

5000 Life Insurance income account. Any gain above the premium that the bank paid would be taxed at the normal rate. When banks purchase COLI.

For example an executive earning 500000 at age 55 might agree to. The buildup of cash surrender value within the policy is included in book earnings but excluded from the calculation of federal taxable income. The bank purchases and owns an insurance policy on an executives life and is the beneficiary.

Taxpayer maintains a BOLI Program in which it acquires life insurance policies from a variety of life insurance providers on a group of its officer-level employees. It should be noted that BOLIs current tax benefits have been unsuccessfully challenged over the years. BOLI has its roots in Corporate Owned Life Insurance which has been used by large corporations for decades to offset employee benefit plan costs and other liabilities.

The BOLI Policies are. The primary benefit of BOLI is its treatment for corporate income tax purposes. In general proceeds from life insurance policies are tax free under the general exception rules in Sec.

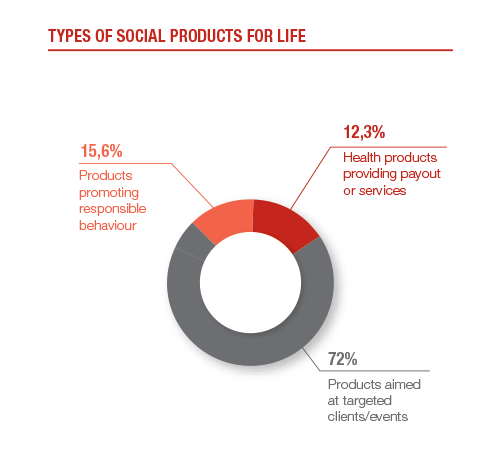

Repeal of tax credit bonds and advance refunding bonds 14 Bank-owned life insurance BOLI 14 Scope of transfer for value rules 14 Treatment of business income and loss of certain non. Sophisticated financial institutions are using BOLI to. Bank Owned Life Insurance BOLI - is an allowable transaction that serves the bank as a competitive tax-free investment.

Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees. Tax treatment is changed. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs.

Financial Stability Review May 2018

Irs Foreign Life Insurance Policy Taxation Is Income Taxable

Research Group Taxation And Fiscal Policy Area Ifo Institute

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Tax Deductible Life Insurance Business Owners

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel

Is Life Insurance Taxable Forbes Advisor

:max_bytes(150000):strip_icc()/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Financial Stability Review May 2018

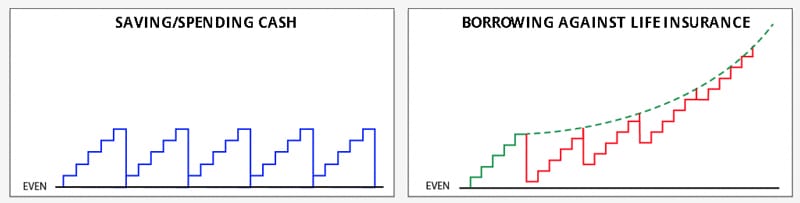

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Financial Stability Review May 2018

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Bank Owned Life Insurance Boli

Do Beneficiaries Pay Taxes On Life Insurance

Life Insurance As A Tax Planning Tool Insights People S United Bank